Hyper-active Hurricane Outlook: NOAA’s May 22 Forecast Pegs the 2025 Atlantic Season as “Above Normal,” a Red Flag for Coastal Insurance Premiums and Investor Risk Models

Introduction

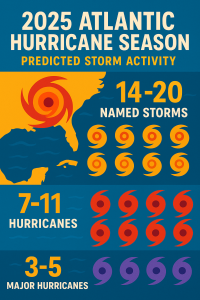

As we approach the 2025 Atlantic hurricane season, the National Oceanic and Atmospheric Administration (NOAA) has released its forecast, predicting an “above normal” hurricane season. NOAA anticipates between 14 to 20 named storms, with 7 to 11 potentially becoming hurricanes, and 3 to 5 of those possibly reaching major hurricane status (Category 3 or higher). This forecast underscores the importance of preparedness, especially for residents in hurricane-prone areas like Davenport, Florida.

For homeowners in Davenport, FL, NOAA’s forecast isn’t just another weather update—it’s a critical piece of information that can significantly impact your financial well-being. Davenport, located in Central Florida, has experienced rapid growth in recent years, attracting new residents and investors alike. However, its proximity to Florida’s coastlines and vulnerability to severe weather events mean that hurricane forecasts directly influence property values, insurance premiums, and overall financial security.

When NOAA predicts an active hurricane season, insurance companies often respond by adjusting their risk assessments. This can lead to higher insurance premiums, stricter coverage terms, or even difficulty obtaining coverage altogether. Additionally, frequent or severe storms can negatively affect property values, as potential buyers become wary of investing in areas perceived as high-risk.

Homeowners who proactively monitor these forecasts and take appropriate precautions can better protect their investments. Staying informed allows you to:

- Anticipate potential changes in insurance costs and coverage.

- Implement preventive measures to safeguard your property.

- Make informed decisions about buying, selling, or investing in real estate.

In this article, we’ll explore in detail how NOAA’s 2025 hurricane forecast could affect Davenport homeowners, including practical steps you can take to mitigate risks and protect your financial future. By understanding the implications of these forecasts, you’ll be better equipped to navigate the upcoming hurricane season confidently.

The 2025 Hurricane Season Outlook: What to Expect

As we approach the 2025 hurricane season, homeowners and investors in Davenport, FL real estate are understandably concerned about potential impacts. The National Oceanic and Atmospheric Administration (NOAA) recently released its hurricane forecast for 2025, providing valuable insights into what we might expect in terms of storm activity and severity.

Predicted Storm Activity for 2025

According to NOAA’s hurricane forecast for 2025, the Atlantic hurricane season is expected to be slightly above average. Specifically, NOAA predicts:

- 14 to 20 named storms (winds of 39 mph or higher)

- 7 to 11 hurricanes (winds of 74 mph or higher)

- 3 to 5 major hurricanes (Category 3 or higher, with winds exceeding 111 mph)

These numbers indicate a moderately active season, emphasizing the importance of preparedness for residents and property owners in hurricane-prone areas like Davenport, Florida.

Factors Influencing the 2025 Hurricane Forecast

Several key factors contribute to NOAA’s predictions for the upcoming hurricane season. Understanding these factors can help homeowners better anticipate potential risks and take proactive measures:

- Ocean Temperatures: Warmer-than-average sea surface temperatures in the Atlantic Ocean and Caribbean Sea provide fuel for storm formation and intensification. NOAA data indicates ocean temperatures are trending higher, increasing the likelihood of stronger storms.

- Atmospheric Conditions: Wind shear, or the change in wind speed and direction with altitude, significantly influences hurricane development. Lower wind shear conditions are expected in 2025, creating a more favorable environment for storm formation.

- El Niño and La Niña Patterns: NOAA forecasts a neutral to weak El Niño pattern for 2025. Typically, El Niño conditions suppress hurricane activity in the Atlantic, while La Niña conditions enhance it. A neutral or weak El Niño scenario suggests moderate storm activity, though uncertainty remains.

Historical Comparisons: How Does 2025 Stack Up?

To put the 2025 forecast into perspective, let’s compare it with recent hurricane seasons:

- 2024 Season: NOAA recorded 16 named storms, 8 hurricanes, and 4 major hurricanes. The 2025 forecast closely mirrors these numbers, indicating a continuation of recent trends.

- 2020 Season: A record-breaking year with 30 named storms, 14 hurricanes, and 7 major hurricanes. Compared to this extreme season, 2025 appears significantly less severe, though still above historical averages.

- Long-term Average (1991-2020): Historically, the Atlantic hurricane season averages 14 named storms, 7 hurricanes, and 3 major hurricanes. The 2025 forecast slightly exceeds these averages, underscoring the importance of vigilance and preparedness.

The Rising Costs of Hurricane Damage: A Financial Burden

When hurricanes strike, the immediate concern is often safety and survival. Yet, once the storm passes, homeowners face another daunting challenge: the staggering financial toll. From skyrocketing repair costs to rising insurance premiums, the economic aftermath of hurricanes can linger for years, reshaping entire communities.

Understanding the Numbers: Insured Losses and Repair Costs

Hurricanes rank among the costliest natural disasters in the United States, with insured losses frequently reaching billions of dollars. According to the National Oceanic and Atmospheric Administration (NOAA), the average annual cost of hurricane damage in the U.S. has surged dramatically over recent decades. Between 2017 and 2021 alone, hurricanes caused approximately $400 billion in damages, with Hurricane Harvey (2017) and Hurricane Ida (2021) each individually surpassing $75 billion in losses.

These figures represent only insured losses—actual repair and rebuilding costs often exceed these numbers significantly. Homeowners frequently face expenses related to:

- Structural repairs and rebuilding

- Mold remediation and water damage restoration

- Temporary housing and relocation costs

- Replacement of personal belongings and vehicles

Economic Impact on Homeowners and Communities

Beyond immediate repair costs, hurricanes have lasting economic consequences for homeowners and local economies. Property values in hurricane-prone areas often decline sharply after severe storms, as potential buyers become wary of future risks. A study published in the Journal of Real Estate Finance and Economics found that homes in hurricane-affected regions can experience value drops of up to 10–15% immediately following a major storm.

Insurance premiums also rise significantly after hurricanes, placing additional financial strain on homeowners. For example, after Hurricane Katrina in 2005, homeowners in coastal Louisiana and Mississippi saw insurance premiums increase by as much as 50–100% within just a few years. These higher premiums can persist for years, making homeownership increasingly unaffordable for many families.

Local economies suffer as well. Businesses close temporarily or permanently, employment opportunities diminish, and tourism revenue declines sharply. The ripple effect can last for years, slowing economic recovery and growth.

Real-World Examples: Lessons from Recent Hurricanes

To fully grasp the financial burden hurricanes impose, consider these recent examples:

- Hurricane Harvey (2017): Harvey caused catastrophic flooding in Houston, Texas, resulting in approximately $125 billion in damages. Thousands of homeowners lacked adequate flood insurance, leaving many financially devastated and unable to rebuild without significant federal assistance.

- Hurricane Michael (2018): Striking Florida’s Panhandle, Michael caused around $25 billion in damages. Many homeowners faced prolonged battles with insurance companies over claims, delaying recovery and compounding financial stress.

- Hurricane Ian (2022): Ian devastated parts of Florida, causing an estimated $112 billion in damages. The storm highlighted vulnerabilities in insurance markets, prompting insurers to reconsider coverage options and pricing, further complicating homeowners’ financial recovery.

Preparing for the Financial Risks Ahead

As ocean temperatures rise and atmospheric conditions become increasingly conducive to hurricane formation, experts predict more frequent and intense storms in the coming years. Homeowners must proactively prepare for these financial risks by:

- Reviewing and updating insurance coverage regularly

- Investing in hurricane-resistant home improvements

- Creating emergency savings funds specifically for disaster recovery

By understanding the financial implications of hurricanes and taking proactive steps, homeowners can better protect themselves from the devastating economic impacts these storms bring.

Navigating the Florida Insurance Market: Challenges and Solutions

Florida homeowners face a uniquely challenging insurance landscape, shaped by frequent hurricanes, rising repair costs, and shifting market dynamics. Understanding these challenges—and knowing how to navigate them—is crucial for protecting your home and finances.

Current Market Overview: Rising Premiums and Limited Options

In recent years, Florida’s homeowners insurance market has become increasingly volatile. According to data from the Insurance Information Institute, Florida homeowners pay some of the highest insurance premiums in the nation, averaging nearly $4,200 annually—almost three times the national average. This surge in premiums is largely driven by escalating hurricane damage repair costs and a sharp rise in insured losses from hurricanes.

Additionally, many insurers have either exited the Florida market or significantly reduced their policy offerings. This reduction in competition leaves homeowners with fewer choices and often forces them into state-backed programs like Citizens Property Insurance Corporation, which has seen its policyholder numbers swell dramatically in recent years.

Challenges for Homeowners: Premiums, Coverage Gaps, and Climate Risks

Florida homeowners face several critical challenges when it comes to insurance:

- Skyrocketing Premiums: Premium increases of 20% to 50% annually have become common, placing significant financial strain on homeowners.

- Coverage Limitations: Many policies now exclude or severely limit coverage for windstorm damage, flooding, and mold remediation—common issues after hurricanes.

- Climate Change Impact: With hurricanes becoming more frequent and intense due to climate change, insurers are increasingly cautious, tightening underwriting standards and raising premiums further.

A recent FEMA report highlights the financial burden of hurricane damage, noting that the average homeowner faces tens of thousands of dollars in uninsured losses after major storms. These uninsured losses can devastate families financially, underscoring the importance of comprehensive coverage.

Potential Solutions: How Homeowners Can Protect Themselves

Despite these challenges, homeowners can take proactive steps to secure affordable, comprehensive coverage:

- Shop Around and Compare Policies: Don’t settle for the first quote you receive. Comparing multiple insurers can help you find better coverage at a more competitive rate. Consider working with an independent insurance agent who can provide multiple quotes and help you understand policy differences clearly.

- Understand Your Coverage Options: Make sure you fully understand what’s covered—and what’s not—in your policy. Pay special attention to exclusions related to windstorm, flooding, and mold. Consider supplemental flood insurance through the National Flood Insurance Program (NFIP), as standard homeowners policies typically exclude flood damage.

- Invest in Home Improvements and Mitigation Measures: Taking proactive steps to strengthen your home against hurricane damage can lower your premiums and reduce repair costs after a storm. Common mitigation measures include:

- Installing hurricane shutters or impact-resistant windows

- Reinforcing roofs and garage doors

- Elevating electrical systems and appliances above flood levels

Florida offers incentives and grants through programs like the My Safe Florida Home initiative, which provides financial assistance for hurricane mitigation improvements.

- Explore State-Backed Insurance Programs: If private insurers are unavailable or unaffordable, consider Citizens Property Insurance Corporation, Florida’s insurer of last resort. While Citizens may have limitations, it can provide essential coverage when other options are limited.

Take Action to Secure Your Home and Finances

Navigating Florida’s challenging insurance market requires diligence, research, and proactive planning. By understanding the current market conditions, recognizing the challenges, and taking advantage of available solutions, you can better protect your home and financial future.

Flood Insurance: Why It’s Essential for Florida Homeowners

Florida is known for its sunny beaches and vibrant communities, but it’s also one of the most flood-prone states in the U.S. With hurricanes, tropical storms, and rising sea levels becoming increasingly common, flood insurance isn’t just a good idea—it’s essential protection for every homeowner in the Sunshine State.

Why Flood Insurance Matters in Florida

Many Florida homeowners mistakenly assume their standard homeowners insurance policy covers flood damage. Unfortunately, this is rarely the case. Standard policies typically exclude flood-related losses, leaving homeowners financially vulnerable when disaster strikes.

Flooding can happen anywhere, not just in coastal areas. Heavy rains, storm surges, and overflowing rivers can quickly turn neighborhoods into disaster zones. According to FEMA, just one inch of floodwater can cause up to $25,000 in damage to your home. Without flood insurance, homeowners must shoulder these costs entirely on their own.

Common Exclusions in Standard Homeowners Policies

Understanding what’s excluded from your standard homeowners insurance policy is crucial. Typically, these policies do not cover:

- Damage caused by flooding from hurricanes, tropical storms, or heavy rainfall

- Storm surge and tidal flooding

- Overflowing rivers, lakes, or drainage systems

- Groundwater seepage or rising water tables

These exclusions mean that even if your home sustains severe flood damage, your insurance provider won’t cover the repairs unless you have a separate flood insurance policy.

The Risks of Being Uninsured: What the Numbers Say

Despite Florida’s high flood risk, many homeowners remain uninsured. According to recent data from the Florida Office of Insurance Regulation, approximately 60% of Florida homeowners do not carry flood insurance. This leaves a significant portion of the population exposed to devastating financial losses.

Consider this scenario: Hurricane Ian in 2022 caused billions of dollars in flood-related damages across Florida. Homeowners without flood insurance faced enormous out-of-pocket expenses, often leading to financial hardship or even bankruptcy.

How to Protect Yourself and Your Home

The good news is that flood insurance is accessible and affordable for most homeowners. Policies are available through the National Flood Insurance Program (NFIP) and private insurers, offering coverage tailored to your home’s specific risk level.

To safeguard your home and finances, consider these steps:

- Assess your flood risk: Use FEMA’s Flood Map Service Center to determine your property’s flood zone.

- Shop around for coverage: Compare NFIP policies with private flood insurance options to find the best coverage and rates.

- Understand your policy: Clearly understand what’s covered and what’s excluded, ensuring no surprises when filing a claim.

Selling a House After a Flood: Options and Considerations

Experiencing a flood can be devastating, both emotionally and financially. For Florida homeowners, deciding what to do next—whether to repair the damage or sell the property as-is—can be challenging. Understanding your options, legal obligations, and financial implications is crucial to making the best decision for your situation.

Options for Homeowners After Flood Damage

When your home suffers flood damage, you generally have two primary paths forward:

- Repair and Restore the Property: Choosing to repair your home involves assessing the extent of the damage, hiring contractors, and navigating insurance claims. This option can be time-consuming and costly, but it may allow you to retain or even increase your home’s value if repairs are thorough and professionally done.

- Sell the Property As-Is: Selling your flooded home without repairs is another viable option. This approach can be quicker and less stressful, especially if you lack flood insurance coverage or the financial resources to handle extensive repairs. However, selling as-is typically means accepting a lower sale price, as buyers will factor repair costs into their offers.

Legal Requirements for Selling a Flood-Damaged Home in Florida

In Florida, homeowners have specific legal obligations when selling a property that has experienced flood damage. Under state law, sellers must disclose any known defects or past issues, including flood events and related insurance claims. Failure to disclose flood damage can lead to legal disputes, financial penalties, and even the reversal of the sale.

To protect yourself legally and ethically, always:

- Clearly document and disclose all flood-related damage and repairs.

- Provide potential buyers with copies of insurance claims and repair receipts.

- Consider obtaining a professional home inspection to verify the property’s condition and reassure buyers.

Transparency not only protects you legally but also builds trust with potential buyers, potentially speeding up the sale process.

Financial Considerations: Repair Costs vs. Market Value

Deciding whether to repair or sell your flooded home involves careful financial analysis. According to FEMA, only about 18% of Florida homeowners carry flood insurance, leaving many financially vulnerable after flooding events. Without flood insurance, homeowners must shoulder the full burden of repair costs, which can quickly escalate into tens of thousands of dollars.

Consider these financial factors carefully:

- Repair Costs: Flood damage repairs can range significantly depending on severity. Common expenses include mold remediation, structural repairs, electrical system replacements, and flooring restoration. A study by FEMA found that just one inch of floodwater can cause approximately $25,000 in damage to a typical home.

- Market Value Impact: Flood-damaged homes typically sell for significantly less than comparable undamaged properties. Buyers often expect substantial discounts to offset repair costs and potential future risks. Additionally, homes located in flood-prone areas may experience reduced market demand, further impacting sale prices.

- Long-Term Financial Implications: Even after repairs, your home’s value may remain lower due to its flood history. Future buyers may be wary of purchasing a previously flooded property, and insurance premiums could rise significantly.

Davenport, FL: A Case Study in Hurricane Risk

When considering selling a house after flood damage, understanding local risks and market dynamics is crucial. Davenport, Florida, provides a clear example of how geographical factors, repair costs, and market trends intersect, influencing homeowner decisions after hurricane-related flooding.

Geographical Risks: Why Davenport is Vulnerable

Davenport, located in Polk County, Florida, faces unique geographical vulnerabilities that heighten its hurricane risk. Although not directly on the coast, Davenport’s proximity to numerous lakes, wetlands, and low-lying areas significantly increases its susceptibility to flooding during heavy storms.

The city’s average elevation is approximately 138 feet above sea level, relatively low compared to inland Florida standards. This modest elevation, combined with flat terrain and limited natural drainage, means heavy rainfall from hurricanes can quickly overwhelm local infrastructure, leading to extensive flood damage.

Cost Analysis: Repairing vs. Selling After Flood Damage

After experiencing flood damage, homeowners in Davenport face a critical decision: invest in repairs or sell the property as-is. To make an informed choice, consider the following cost factors:

- Average Repair Costs: According to FEMA, the average homeowner spends between $20,000 and $50,000 repairing flood damage, depending on severity. Major structural repairs, mold remediation, and electrical system replacements can push costs even higher.

- Impact on Property Value: Homes with documented flood damage typically see a reduction in market value of 15% to 25%, according to the National Association of Realtors. In Davenport, where the median home value is approximately $350,000, this could mean a potential loss of $52,500 to $87,500 in property value.

- Insurance Considerations: Florida property disclosure laws require sellers to disclose past flood damage, potentially deterring buyers or lowering offers. Additionally, flood insurance premiums in high-risk areas like Davenport can rise significantly after a claim, further impacting affordability.

Local Market Trends: How Hurricane Season Affects Davenport Real Estate

The forecasted hurricane season directly influences Davenport’s real estate market. Buyers become more cautious, and insurance companies adjust premiums based on predicted storm activity. Here are key trends to watch:

- Property Values: Historically, Davenport home values experience temporary dips following active hurricane seasons. However, values typically rebound within 12 to 18 months, provided no additional severe storms occur.

- Insurance Premiums: After major storms, insurance providers reassess risk, often increasing premiums. In Florida, homeowners have seen flood insurance premiums rise by as much as 20% to 30% following significant hurricane events.

- Buyer Behavior: Potential buyers become more vigilant about flood risks, often requesting detailed property disclosures and flood history reports. Sellers who proactively address flood damage and provide thorough documentation can mitigate buyer concerns and maintain stronger negotiating positions.

Investor Risk Model Adjustments

As hurricane activity intensifies, investors are increasingly reassessing their strategies, particularly in vulnerable coastal regions like Davenport, Florida. NOAA’s recent forecasts indicate a rising frequency and severity of hurricanes, prompting investors to reconsider how they evaluate risk and allocate resources. Understanding these shifts is crucial for anyone involved in Davenport FL real estate, whether you’re an individual investor, part of a real estate investment trust (REIT), or simply a homeowner looking to protect your property’s value.

How Investors Are Adapting Their Strategies

Traditionally, coastal properties have been attractive investments due to their high appreciation rates and strong rental demand. However, the growing threat of hurricanes is reshaping investor behavior. Investors are now incorporating advanced risk modeling tools that factor in climate change projections, flood zone maps, and historical hurricane data.

For example, Davenport’s local government reports indicate that approximately 35% of residential properties lie within designated flood zones. With average hurricane-related repair costs in the area ranging from $20,000 to $50,000 per property, investors are becoming more cautious. They’re increasingly prioritizing properties located in higher-elevation areas or those built with hurricane-resistant construction methods.

Some common strategies investors are adopting include:

- Diversifying portfolios to include inland properties or regions less prone to hurricane damage.

- Increasing due diligence by closely examining flood insurance premiums, historical storm damage, and local infrastructure resilience.

- Allocating funds toward retrofitting existing properties with hurricane-resistant features, such as reinforced roofs, impact-resistant windows, and improved drainage systems.

The Impact on REITs and Coastal Property Holdings

Real estate investment trusts (REITs), which often hold significant coastal property assets, are particularly sensitive to these changing risk models. As investors demand greater transparency and risk mitigation, REITs are adjusting their portfolios accordingly.

For instance, some REITs are shifting their focus away from high-risk coastal areas toward more stable inland markets. Others are proactively investing in property upgrades and resilience measures to maintain investor confidence and property values. According to recent market analyses, REITs with significant coastal holdings have experienced increased volatility, prompting many to reevaluate their long-term strategies.

Preparing for the Future: Mitigation and Resilience

When hurricane season approaches, proactive preparation can mean the difference between minor inconvenience and devastating loss. Homeowners who invest time and effort into mitigation and resilience strategies not only protect their families and properties but also significantly reduce financial and emotional stress after a storm. Here’s how you can effectively prepare your home and community for hurricane season.

Practical Steps for Hurricane Preparedness

Taking actionable steps ahead of time is crucial. Here are essential measures every homeowner should consider:

- Create a Comprehensive Emergency Plan

- Identify evacuation routes and local shelters.

- Establish clear communication plans with family members.

- Keep important contacts, such as emergency services and insurance providers, easily accessible.

- Secure Your Property

- Install hurricane shutters or impact-resistant windows.

- Reinforce garage doors and roofs to withstand high winds.

- Trim trees and remove loose branches or debris around your property.

- Stock Essential Supplies

- Maintain a disaster supply kit with water, non-perishable food, medications, batteries, flashlights, and first-aid supplies.

- Ensure you have enough supplies to last at least three to seven days without external assistance.

The Importance of Documentation for Insurance Claims

Proper documentation is often overlooked but is critical for a smooth insurance claims process after a hurricane. According to a recent report by real estate investment firms analyzing investor risk models for hurricanes, properties with thorough documentation experience significantly faster claim resolutions and higher reimbursement rates.

Here’s how you can effectively document your property:

- Conduct a Home Inventory: Take detailed photos and videos of your home’s interior and exterior, including valuable items and appliances. Store these digitally in cloud storage or on a secure external drive.

- Keep Receipts and Records: Maintain receipts for major purchases, renovations, and repairs. These documents help establish the value of your belongings and property improvements.

- Review Your Insurance Policy: Regularly update your coverage to reflect current property values and ensure you understand your policy’s terms, deductibles, and exclusions.

Leveraging Community Resources for Enhanced Resilience

Communities often provide valuable resources to help homeowners prepare for and recover from hurricanes. Leveraging these resources can significantly enhance your preparedness and resilience:

- Local Emergency Management Offices: Many municipalities offer free workshops, preparedness guides, and evacuation route maps.

- Community Preparedness Programs: Programs like CERT (Community Emergency Response Team) train residents in disaster response skills, enabling them to assist neighbors and emergency responders effectively.

- Financial Assistance and Grants: Some local governments and non-profits provide grants or low-interest loans to help homeowners retrofit their properties for hurricane resilience.

Homeowner Action Plan

Recovering from a flood can feel overwhelming, but having a clear action plan can significantly ease the process. By taking immediate steps after filing your flood claim and implementing long-term strategies, you can enhance your home’s resilience and reduce future risks. Here’s a comprehensive homeowner action plan to guide you through recovery and preparedness.

Immediate Steps Post-Flood Claim

Once you’ve filed your flood insurance claim, it’s crucial to act quickly and methodically. FEMA guidelines emphasize that prompt action can significantly reduce further damage and speed up recovery.

- Contact Your Insurance Provider Immediately: Notify your insurance company as soon as possible. Provide detailed information about the damage and ask about next steps, including when an adjuster will visit your property.

- Document the Damage Thoroughly: Take clear photos and videos of all affected areas before starting any cleanup. This documentation will be essential for your claim and can help ensure you receive fair compensation.

- Begin Safe Cleanup Efforts: After documenting, start removing water and drying out your home to prevent mold growth. Wear protective gear and follow safety guidelines provided by FEMA or your local emergency management agency.

- Secure Temporary Housing if Needed: If your home is unsafe or uninhabitable, arrange temporary accommodations. Check with your insurance provider about coverage for temporary housing expenses.

Long-Term Strategies for Homeowner Resilience

Beyond immediate recovery, homeowners should adopt long-term strategies to mitigate future flood risks. According to FEMA, every dollar invested in preparedness and mitigation saves an average of six dollars in future disaster recovery costs.

Home Improvements for Flood Mitigation

Consider these home upgrades to enhance your property’s resilience:

- Elevate Critical Utilities: Move electrical panels, HVAC systems, and water heaters above potential flood levels.

- Install Flood-Resistant Materials: Use water-resistant drywall, flooring, and insulation in lower-level areas prone to flooding.

- Invest in Flood Barriers: Install flood vents, barriers, or sump pumps to reduce water intrusion during future floods.

Landscaping and Drainage Solutions

Your yard and landscaping play a significant role in flood prevention:

- Create Proper Grading: Ensure your yard slopes away from your home to direct water runoff effectively.

- Plant Flood-Resistant Vegetation: Trees, shrubs, and groundcovers with deep root systems can absorb excess water and stabilize soil.

- Install Rain Gardens and Permeable Surfaces: These features help manage stormwater runoff naturally, reducing flood risk.

Community Involvement and Advocacy

Flood resilience is a community-wide effort. Engage with local initiatives to strengthen your neighborhood’s preparedness:

- Participate in Community Floodplain Management Programs: Join local meetings and advocate for improved infrastructure and flood mitigation projects.

- Stay Informed and Connected: Sign up for local emergency alerts and participate in community preparedness drills.

Conclusion

As NOAA’s latest forecast clearly indicates, this hurricane season demands proactive preparation from homeowners. With predictions pointing toward increased storm activity and potential flooding, understanding your risks and taking timely action is more critical than ever.

Throughout this guide, we’ve highlighted essential steps every homeowner should take, including:

- Reviewing and updating your flood insurance coverage through the National Flood Insurance Program (NFIP).

- Understanding the flood claim steps clearly, from initial documentation to final settlement.

- Implementing proven mitigation strategies, such as elevating utilities, installing flood barriers, and improving drainage systems, which can significantly reduce property damage.

Statistics from FEMA show that every dollar invested in flood mitigation saves an average of six dollars in future disaster recovery costs. Clearly, proactive measures not only protect your home but also offer substantial financial benefits.

Remember, preparation is your strongest defense. Don’t wait until a storm is imminent—take action now to safeguard your home and family. If you’re unsure where to start, reach out to local government agencies, your insurance provider, or community organizations. These resources are designed to help you navigate the complexities of hurricane preparedness and flood recovery.

To simplify your planning, we’ve created a downloadable PDF checklist outlining a comprehensive homeowner action plan for hurricane season. Use it to ensure you’ve covered all critical steps, from securing insurance coverage to implementing long-term flood mitigation strategies.

Ready to take the next step? Download Your Homeowner Action Plan Checklist (PDF) and start preparing today.